The Ultimate Guide To Dubsado’s Payment Plans

Choosing the right Dubsado payment option for your services has never been easier.

While you’re passionate about your business and dedicated to serving your clients, the key to long-term success often boils down to one simple thing – getting paid on time. But discussing money can be uncomfortable, even when you’re confident about your work’s value.

And those follow-up emails reminding clients to settle their invoices? The worst.

Here’s the good news – Dubsado’s payment plans change the game. They make creating invoices, requesting payments, and tracking your cash flow easy. Plus, when you use payment plans in your business, you’re not just ensuring you’re paid promptly. You’re also fostering trust and transparency with your clients.

In this guide, we delve into payment plans, exploring what they are, how important they are to your business, and how to choose the right option for your services.

The importance of payment plans

You’re in the business of delivering high-value design or copywriting projects with your price tags reaching four or five figures. Expecting to pay the entire sum upfront is a tall order for most small businesses. But waiting until the project’s completion to see that cash come into your bank account? Not an option either.

This is why payment plans are so important.

Payment plans break large purchases into manageable installments. Not only do they ease the financial strain for your clients, but they also offer advantages for you.

- Payment plans can help you sell higher-priced projects because your clients can pay you over time.

- Payment plans give you a more predictable monthly income and financial stability.

- Payment plans foster a sense of trust between you and your clients as you’re both equally invested in the project’s completion.

Essentially, payment plans help connect your clients’ financial comfort, your business’s financial stability, and the trust that binds your professional relationships.

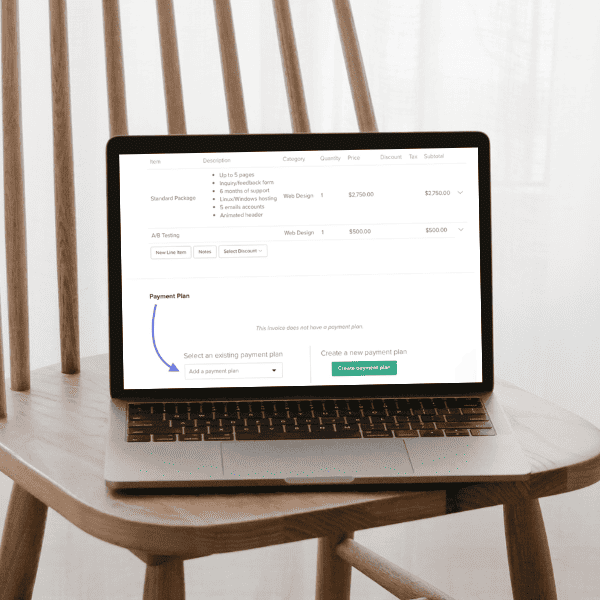

The standard payment plan options in Dubsado

Pay-In-Full Payment Option

What it is: The ‘pay-in-full’ option allows your clients to make a single payment covering the entire project’s cost.

When to use it: This option is ideal for clients who are comfortable making a lump-sum purchase and want to complete the transaction quickly. It’s best used for lower-priced projects (<$500) with shorter timelines. This way you won’t strain your client’s wallets or leave them wondering if they’ll receive the work they paid for.

Who’s used it: We set up the pay-in-full option for Isobel’s ‘website audit service. Clients pay the full amount upfront and then book their copy audit immediately after. The lower cost and quick turnaround made it the ideal service for this payment option.

50/50 Payment Plan Option

What it is: The ‘50/50’ payment plan divides the total cost of your project session into defined payments. While this could be a 50/50 split, you could also break up the payment into smaller, more frequent amounts. Typically, one payment is due after the contract is signed and the other upon project completion.

When to use it: This plan is one of the most common payment options for service providers. The 50/50 split shares the financial risk and responsibility between you (the business owner) and your client. It’s best used for projects where your clients may find it challenging to pay the entire cost upfront, or for projects that stretch out over a few months.

Who’s used it: Copywriter Kristin offers her clients a variety of payment options including a pay-in-full, 50/50, and 25/25/25/25 split to ease the financial burden of investing in their business.

Recurring Invoices

What it is: Where 50/50 payment plans break a large investment down into manageable payments, recurring invoices are for projects that repeat every month. The invoices can be scheduled to be sent out every month until the contract ends.

When to use it: Use recurring invoices when you are charging the same amount for a service each month, whether or not you have an end date. Typically, this type of invoice is used for retainer projects like ongoing blogging or social media management.

Who’s used it: We implemented recurring invoices for StoryWell Marketing. As a digital marketing agency, StoryWell offers monthly social media management packages that require a 3-month commitment. Since the invoices for each month are the same, recurring invoices are the perfect payment option for clients!

Choosing a due date for your payment plan

Once you’ve landed on the type of payment plan that aligns with your services and your client’s needs, the next step is deciding when you should be paid. Dubsado offers three ways to set up due dates for your payment plans.

Fixed Due Dates: Fixed due dates involve picking a specific day of the month when payments are due. These work well for recurring invoices or businesses that operate on strict schedules.

Relative Due Dates: Relative due dates are linked to specific milestones within your workflows. When an action is completed, like signing a contract or delivering the final version of a project, payment reminders are triggered.

TBD Due Dates: TBD due dates are typically used at the start of a project when the exact completion date is not known. This approach prevents the need for constant date adjustments and accommodates evolving project schedules. However, one downside of TBD due dates is that it prevents you from using the autopay feature in Dubsado. (Learn more about autopay below!)

Making the most of autopay in Dubsado

Dubsado’s autopay feature is the best way to ensure invoices are always paid on time. Once configured, Dubsado will automatically charge your client’s preferred payment method on a specific due date.

Autopay is especially handy for recurring invoices and payment plans that have fixed or relative due dates (not TBD dates) because it eliminates the need for your clients to remember to pay each month. It offers a level of reassurance for you and convenience for your clients.

Elevating your business with Dubsado’s payment plans

Ensuring financial stability for your business and nurturing trust with your clients are essential pieces of building a thriving business. Dubsado’s payment plans serve as a powerful tool to achieve both of these goals.

As a Dubsado strategist, I’ll collaborate with you to identify the option that aligns with each of your services, cash flow considerations, and clients’ needs. Then, I’ll seamlessly integrate these payment plans into your automated workflows. Say goodbye to creating invoices, sending reminders, or handling uncomfortable ‘Hey, you haven’t paid yet!’ conversations.

But there’s more to your client experience than just choosing a payment plan. We’ll also examine every interaction you have with your clients, from the first inquiry to the offboarding, to streamline your processes and save you more time.

Ready to get started? Then reach out and book a free Discovery Call.